Support & Services

RAINN is America’s largest anti-sexual violence nonprofit, providing confidential, trauma-informed, 24/7 support services to survivors and their loved ones.

RAINN helps hundreds of thousands of survivors annually through the National Sexual Assault Hotline, the DoD Safe Helpline, and its other victim services programs.

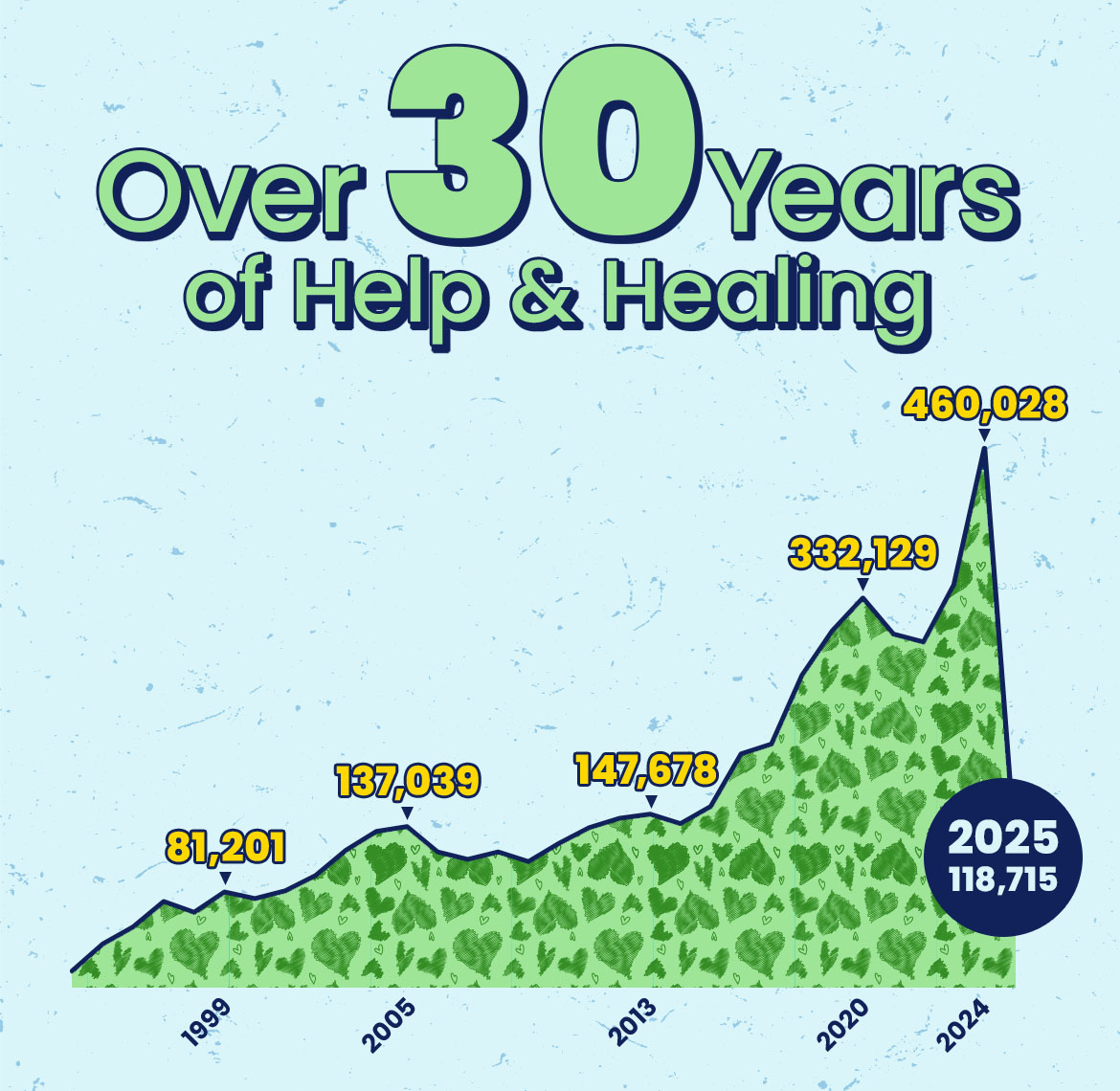

Over 30 Years of Help & Healing

Until 1994, survivors of sexual violence often struggled to find crisis support. In response, RAINN developed the National Sexual Assault Hotline, combining the convenience of a single phone number with the expertise of local programs.

To date, millions of survivors have used the National Sexual Assault Hotline for support, information, and advice.

If you or someone you know has experienced sexual assault, you are not alone. RAINN’s National Sexual Assault Hotline offers free, confidential, 24/7 support in English and en Español.

DoD Safe Helpline is the sole secure, confidential, and anonymous crisis support service specially designed for members of the Department of Defense community affected by sexual assault.

Call 877.995.5247

Chat at online.safehelpline.org

Our Support Services

At RAINN, we believe every survivor of sexual violence deserves to be heard, believed, and helped.

RAINN’s National Sexual Assault Hotline

RAINN’s team of trained support specialists provides compassionate crisis support 24/7/365 via the National Sexual Assault Hotline.

Safe Helpline

RAINN operates the DoD Safe Helpline for the Department of Defense, providing secure, confidential help and resources to members of the U.S. military and their families worldwide.

Youth Helproom

RAINN’s Youth Helproom hosts moderated group chats for 14-24-year-old survivors of sexual violence. These chats are anonymous and confidential.

Local Support Centers

RAINN partners with more than 1,000 local sexual assault service providers that offer short- and long-term support in the community. You can reach your local center by calling 800-656-HOPE.

Our Impact

RAINN’s victim services programs connect survivors to compassionate support and vital resources.

423K

An estimated 423,020 people age 12+ experience sexual violence each year in the U.S.

57,329

Child protective services substantiated or found evidence of sexual abuse for 57,329 children in 2016.

29,000

Active duty service members who experienced unwanted sexual contact. (Department of Defense FY 2023)

Over 5 million people have been helped since 1994.

RAINN’s victim service programs have helped more than 5 million people since 1994.

See More Facts & StatisticsRAINN’s victim service programs aided 460,028 people in ‘24

RAINN’s victim service programs helped 460,028 people in 2024.

See More Facts & StatisticsSelf-Guided Support for Survivors

Getting Medical Help After Sexual Assault

Explore the options for protecting your health and obtaining a rape kit—a sexual assault forensic exam.

Reporting Sexual Assault to Law Enforcement

Find out what to expect if you report sexual assault to the police and if your case goes to trial.

If you or someone you know has experienced sexual assault, you are not alone. RAINN’s National Sexual Assault Hotline offers free, confidential, 24/7 support in English and en Español.

Join Our Community

Join the Fight for a World Free from Sexual Violence

Sign up for inspiring stories, important updates from RAINN, and tools to take action in your community.